3 Budgeting Methods for When Money is Tight: How to Make Your Budget Work for You

With inflation hitting 8.5%, the highest since 1982, smart saving is more important than ever. Learn practical tips to protect your hard-earned money.

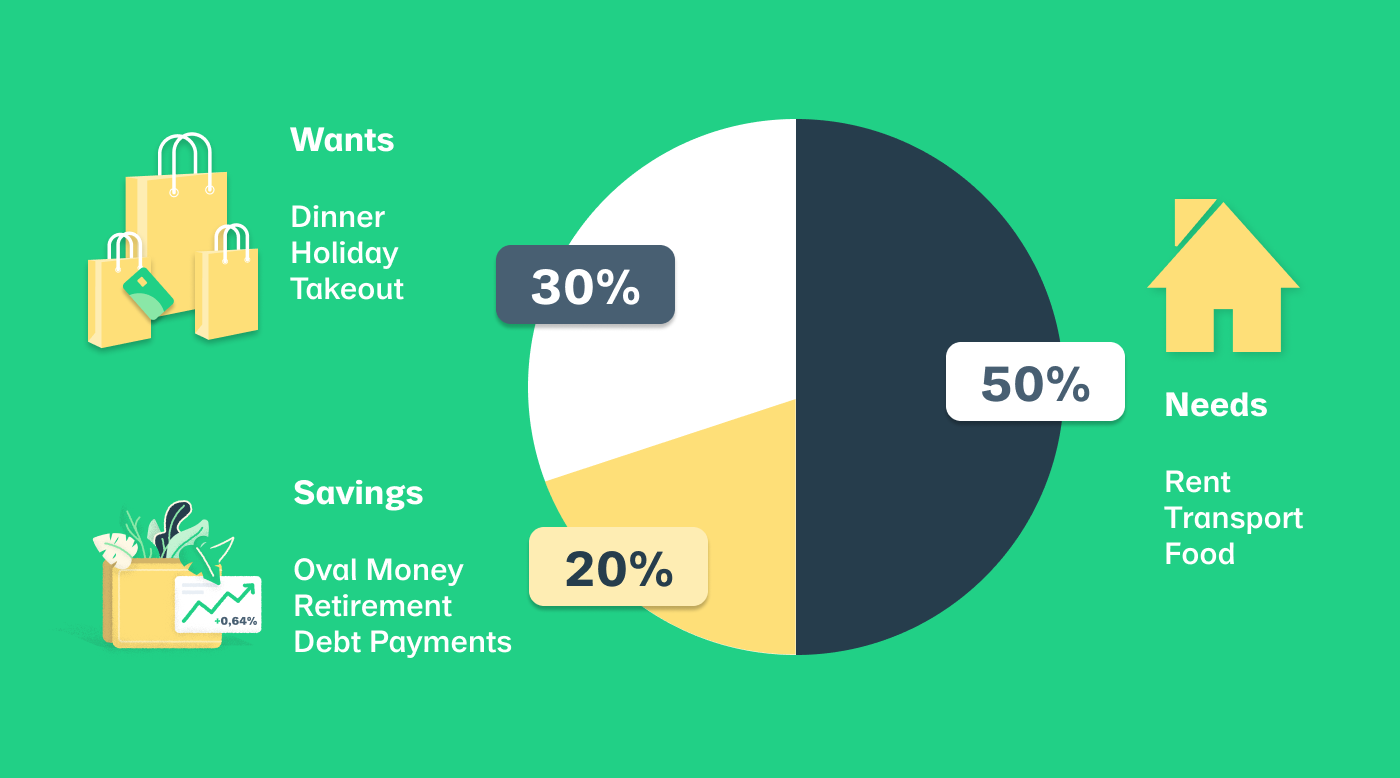

What is the 50/30/20 rule?

Consider following the 50/30/20 rule. The 50/30/20 rule (also known as 50/20/30) divides after-tax income into three different spending categories:

🍞Essentials - 50%

👠Wants - 30%

🪙Savings - 20%

Essentials include necessary living expenses like housing, food, transportation, utility bills, minimum debt repayments, and healthcare costs.

Wants include optional expenses that can enhance your lifestyle, such as eating out, entertainment, travel, new clothes, or anything that gives you joy. The more you can reduce the “wants” bucket, the more room you’ll have for savings.

Savings include future-oriented activities like an emergency fund, retirement, or investments in the stock market. This bucket also accounts for extra debt repayments to reduce your principal and minimize interest.

This simple 50/30/20 formula can help you cover your expenses, save for the future, and leave room for activities that make you happy.

3 Tips for Successful Budgeting

1. Get back to the basics

Track what you earn and what you spend. Keep it simple, organized, and predictable by listing your expenses in a budgeting tool.

2. Try a Zero-Based Budget

A zero-based budget assigns every incoming dollar with a specific job or purpose. Whether it’s spending, savings, or debt repayment, ever dollar is accounted for - no dollar left behind. This technique can give you a sense of control over where your money is going every month to ensure that you minimize wasteful spending and unnecessary expenses.

3. Revisit your budget monthly and annually

Your financial goals change over time and keeping a budget is an on-going process. Set aside time each month to evaluate what you actually spent versus what you intended to spend. You might find that you spent more than anticipated on a certain category, which could signal that you need to cut spending elsewhere. When you review your budget, you can adjust accordingly.

How to Make Your Budget More Fun and Interesting

Make room for fun

Sometimes you splurge on impulse buys because you’ve been too strict with your budget. Avoid depriving yourself and allow room for flexibility to prevent emotional spending on expensive items you hadn’t planned for.

Picture yourself reaching your financial goals

Use images to motivate yourself to stick to your spending plan. Edit yourself into photos with that new car or on vacation at your dream destination. Take an edited screenshot of your loans with $0 money owed to pay back all your debt. Place the photos where you often see them to keep you focused on what you’re saving toward.

Up Your Savings With Meltek

“Do not save what is left after spending; instead spend what is left after saving.” – Warren Buffet

When it comes to least desired, but necessary expenses, electricity bills may be at the top of the list.

Thankfully, here at Meltek, we found a way to help you save money by reducing energy usage. When you sign up as a Con Ed customer in New York City or Westchester, we pay you to reduce energy use when the demand for electricity exceeds supply.

Our program is also available in Long Island, Rockland County, Sullivan County and Orange County (NY). Check if you are eligible by signing up with your zipcode at app.meltek.io.

Utility companies, such as Con Edison, PSEG and O&R, would rather pay you to use less energy than fire up polluting and expensive Peaker Plants. When you reduce your energy consumption, you earn. Sign up with Meltek!

Sign up for our free program and start earning with us. We’re here to help!

Learn more on how it works here.

Subscribe to our blog for more information on how to earn money while saving energy.

Ready to Start Earning?

Join thousands of users who are already earning rewards while helping the environment.